The revenue collected through stamps and registration of properties, which reflects the mood of the real-estate sector in the State, has witnessed tepid growth — around 2.5% — during the current financial year.

The fall in the rate of growth is perceptible when compared to what it was in the last two years. During 2017-18, the figure was 9.01%, and the following year, 16.42%.

In the first six months of the current year, the growth rate was on the negative side of about 2%. “Now, we are experiencing positive signals,” says an official in the Registration Department.

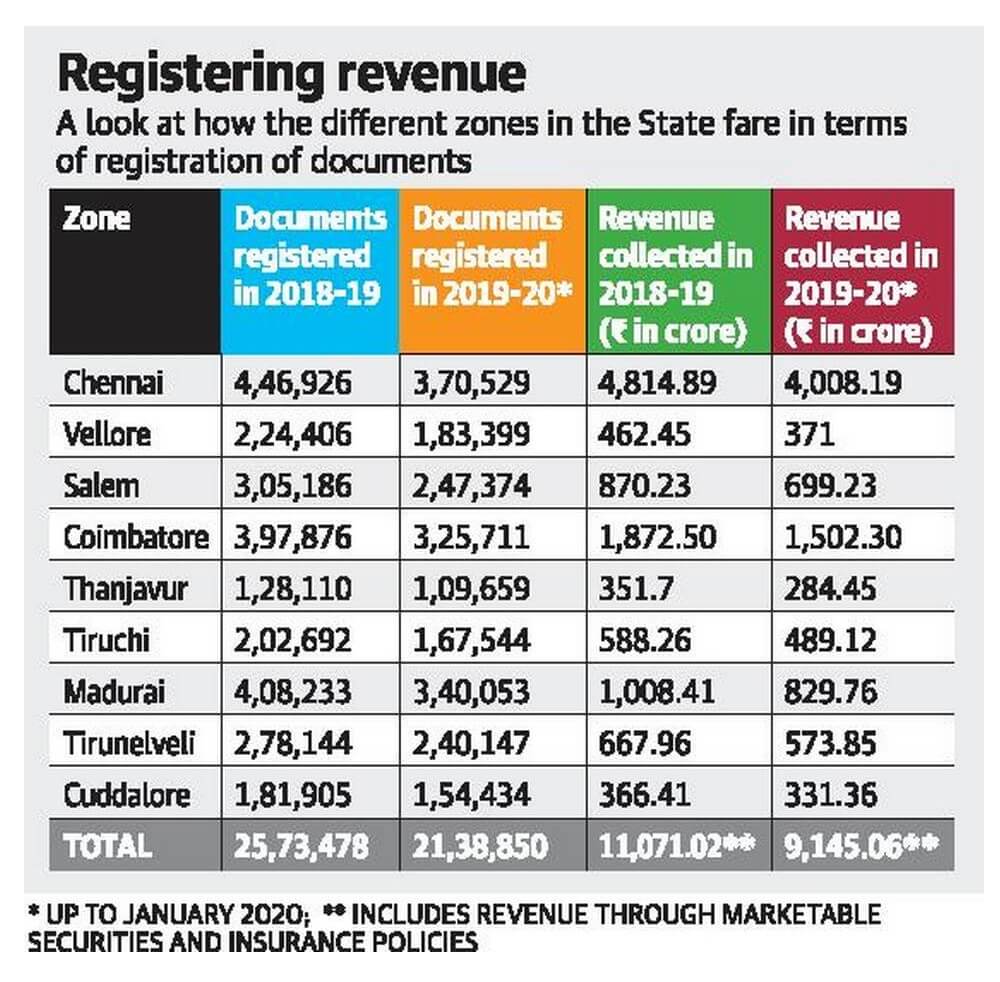

In terms of registration, around 21.38 lakh documents were registered during April 2019-January 2020 — 2.69% higher than the figure for the corresponding period last year. Likewise, the State has, so far, netted about ₹9,145 crore — 2.3% more than what it got last year.

As per revised estimates, the State government expects to get ₹13,123 crore in total for the current year. This means that in the months of February and March, the collection should be ₹3,977 crore, whereas it was around ₹2,134 crore in the last two months of the previous financial year.

The overall economic slowdown has been attributed to the sluggish growth rate. However, the situation may see a change for the better, according to officials and representatives of the sector.

Modest increase

To encourage voluntary compliance and enable both landlords and tenants to realise the full benefits of registration under the new Tenancy Act, the government has reduced the stamp duty for rental agreements for residential property for up to 5 years, from 1% to 0.25 %, and registration charges from 1% to 0.25 %, subject to a maximum of ₹5,000.

Though the quantum of the rise in revenue has not yet been estimated, there will be a modest increase at least, according to the officials in the Registration and Housing & Urban Development Departments.

S. Ramaprabhu, chairman, Southern Centre of the Builders’ Association of India, said the full impact of the simplification and fine-tuning of the Common Development and Building Rules, especially the increase in the average floor space index to 2, will be felt next year and will lead to a further increase in revenue.

Clearing hurdles

Besides, when the approval of applications for regularisation of unauthorised plots and layouts picks up further momentum, it will fetch more revenue.

As of now, around two lakh out of 8.35 lakh applications have been cleared, Mr. Ramaprabhu pointed out, adding that if the legal hurdles to the regularisation of unauthorised buildings were overcome, that will also yield more revenue to the government.

(Source: The Hindu)